Small Infill Projects.

HK DEVELOPMENT GROUP

Small Infill Projects. Big Time Results.

Big Time Results.

Your full-cycle development partner for high-impact ADU and small multifamily infill projects in San Diego.

Your full-cycle development partner for high-impact ADU and small multifamily infill projects in San Diego.

Build Wealth Without Doing It All Yourself

We help capital-backed clients — from 1031 buyers to busy professionals — turn underutilized properties into cash-flowing assets through small-scale infill development.

Whether you’re sitting on land, liquidity, or both — we manage the full lifecycle:

Deal Sourcing

Search both on & off market, utilizing our extensive network to analyze and identify the best opportunities for your specific investment goals and timeline.

Design & Permitting

Work with vendors, source bids, and render drawings of the plan set. Then work with the city through several ideations to get permits stamped & approved.

Construction Management

Manage contractors and perform frequent site walks to validate quality assurance and adherence to the deadlines agreed upon.

Exit Strategy

We offer strategic oversight and assist in the process of refinanciing, tenant screening, & leasing out, or disposition and the process of selling.

It’s development — without the overwhelm.

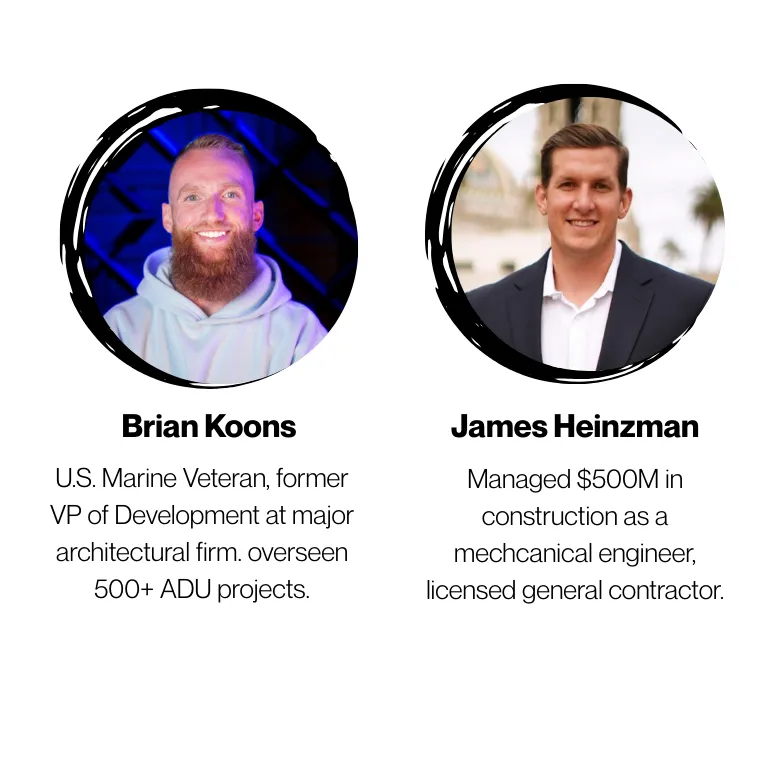

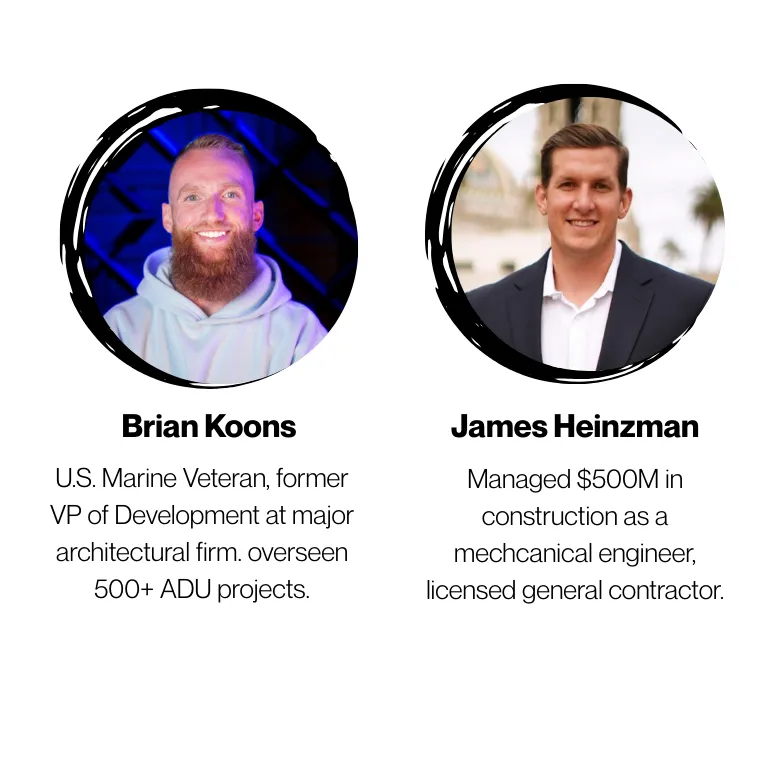

Meet The Team

Behind HK Development

With over a decade of combined expertise and more than $25 million in assets under management, founders Brian Koons and James Heinzman deliver unparalleled leadership in ADU construction management. Brian’s track record includes overseeing the development of nearly 1,500 units across Southern California, while James brings a strong background in project management and engineering for large-scale residential and commercial projects. Together, they provide clients with a seamless, white-glove experience from initial concept to project completion, ensuring every detail is expertly managed.

With over a decade of combined expertise and more than $25 million in assets under management, founders Brian Koons and James Heinzman deliver unparalleled leadership in ADU construction management.

Brian’s track record includes overseeing the development of nearly 1,500 units across Southern California, while James brings a strong background in project management and engineering for large-scale residential and commercial projects.

Together, they provide clients with a seamless, white-glove experience from initial concept to project completion, ensuring every detail is expertly managed.

Our Experience

The team has successfully managed dozens of ADU projects from concept through completion, expertly handling complex permitting, design, and construction processes with efficiency and precision. We are committed to providing a seamless, high-touch service that ensures clear communication and peace of mind for every client. With a proven process and strong industry relationships, HK Development consistently exceeds expectations at every stage of the project.

Assets Under Management

ADU Projects

Consulted On

Years of Industry Experience

Assets Under Management

ADU Projects Consulted On

Years of Industry Experience

Who This is Perfect For

1031 Exchange Buyers

Family Offices

High-Income Professionals

Land owners

High-Income Professionals

1031 Exchange Buyers

Family Offices

Land owners

What We Offer

Full-Cycle Development

For: Investors or landowners who want a done-for-you project

You bring capital or a qualified property

We handle strategy, feasibility, design, permitting, construction, and final exit

You get clear updates, milestone reports, and backend profit splits

Project Management

For: Owners who already have a property or plans

You’ve got a parcel or entitled project

We step in to manage construction, timelines, contractors, and compliance

You avoid the mistakes that cost others tens of thousands and months of delay

Sample Deal Structure

You: Fund acquisition + construction

We: Handle design, permits, bids, scheduling, and budget management

You: Get milestone updates and profit visibility

We: Earn fees and equity for delivering the result

Why Infill ADUs?

Our projects are built around a tested, profitable model

Renovate the existing house

Permit & build 2–5 new detached ADUs

Exit through refinance, sale, or long-term hold

After managing 500+ ADU projects, we’ve seen small-scale infill outperform other real estate niches:

✔️ Multiple exit strategies

✔️ Better financing options

✔️ Low competition, high demand

✔️ Predictable timelines and returns

✔️ Fastest path to stabilized wealth

Why Infill ADUs?

Our projects are built around a tested, profitable model

Renovate the existing house

Permit & build 2–5 new detached ADUs

Exit through refinance, sale, or long-term hold

After managing 500+ ADU projects, we’ve seen small-scale infill outperform other real estate niches:

✔️ Multiple exit strategies

✔️ Better financing options

✔️ Low competition, high demand

✔️ Predictable timelines and returns

✔️ Fastest path to stabilized wealth

STILL NOT SURE?

Frequently Asked Questions

Question 1: Do I need to already own property to work with you?

A: Not at all. Many of our clients come to us with capital only — we help source the right property for your goals and manage the development from end to end.

Question 2: How is this different from hiring a general contractor or architect?

A: We’re not selling you plans or construction services — we’re selling you results. As developers, we operate from the lens of ROI, timelines, and feasibility — not just design or materials.

Question 3: How are your fees structured?

A: We typically charge milestone-based project management or development fees. For full-cycle projects, we may also structure backend profit participation depending on deal type and risk profile.

Question 4: What kind of returns can I expect?

A: Every project is different, but we underwrite conservatively and always build in multiple exit strategies. We’ll show you real pro formas during our discovery call.

Question 5: I have capital, but no property. Can I still work with you?

A: Yes — many of our clients come to us with funds to deploy (e.g., 1031 exchange, liquid cash) but no specific property. We’ll help source deals that match your goals, handle the due diligence, and manage the project from start to finish.

Question 6: I already own a property. Can you just manage it for me?

A: Absolutely. If you own a property with development potential, we can step in as your project manager to oversee the design, permitting, bidding, construction, and delivery — leveraging systems built from 500+ ADU projects.

Question 7: What’s the typical timeline for a project?

A: Most projects run 12–18 months from acquisition to final completion, depending on site conditions, permitting delays, and build complexity. We proactively manage each phase to reduce downtime and avoid costly errors.

Question 8: How much capital do I need to work with you?

A: It depends on your goals, but most of our full-cycle development clients bring between $500K–$2M+. For landowners seeking project management only, we work on milestone-based billing tied to the complexity and scope of your build.

Question 9: Do you offer guaranteed returns or investment advice?

A: No — HK Development does not provide financial, legal, or investment advice, nor do we offer guaranteed returns. All real estate carries risk. We act as your development partner and project manager, not as a financial advisor or fund manager.

Question 10: How do I know if my property qualifies for development?

A: Once you submit your address, we’ll conduct a free preliminary feasibility screen based on zoning, overlays, setbacks, and utilities. If your property passes our criteria, we can move into deeper due diligence and start building a tailored plan.

Question 11: I’m on a 1031 timeline. Can you move quickly?

A: Yes. We have a clear intake and due diligence process specifically for 1031 exchange clients. We can quickly review deals, provide feasibility studies, and help structure a full-cycle development to meet your exchange deadlines.

Question 12: What’s the first step if I’m interested?

A: Just fill out our quick intake form or book a discovery call. We’ll review your goals, whether you're bringing capital, land, or both — and we’ll let you know if it’s a fit. From there, we’ll outline the next steps to move forward with confidence.

READY TO GIVE US A TRY?

Let’s Build Something Worth Holding.

If you have capital, property, or an idea — let’s explore whether we’re the right development partner for your goals.

Legal Disclaimer

HK Development does not provide financial or investment advice. All investments are subject to market risk, construction delays, and regulatory changes. A formal agreement must be signed before services begin. All potential partners must undergo a qualification process. HK Development is not a licensed investment advisor, broker-dealer, or real estate brokerage. All services are offered as development and project management support only. Clients should consult with licensed professionals for financial, tax, or legal advice. Past project outcomes do not guarantee future results. Real estate development involves inherent risks including cost overruns, permitting delays, and market shifts.

COPYRIGHT © 2025 HK Development. ALL RIGHTS RESERVED.